Multiply the biweekly Federal income tax withholding by 26 to obtain the annual Federal income tax withholding and subtract this amount from the gross annual wages computed in step 4. The state’s income tax system features one of the highest top rates, which at 8.53 ranks among the highest states.

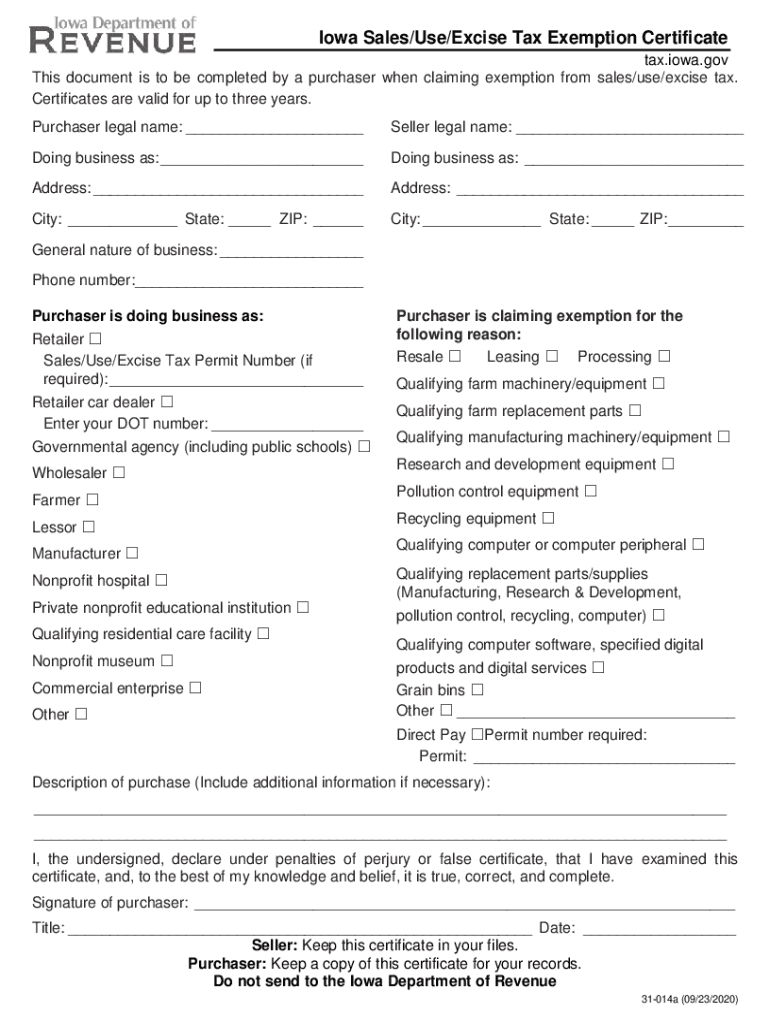

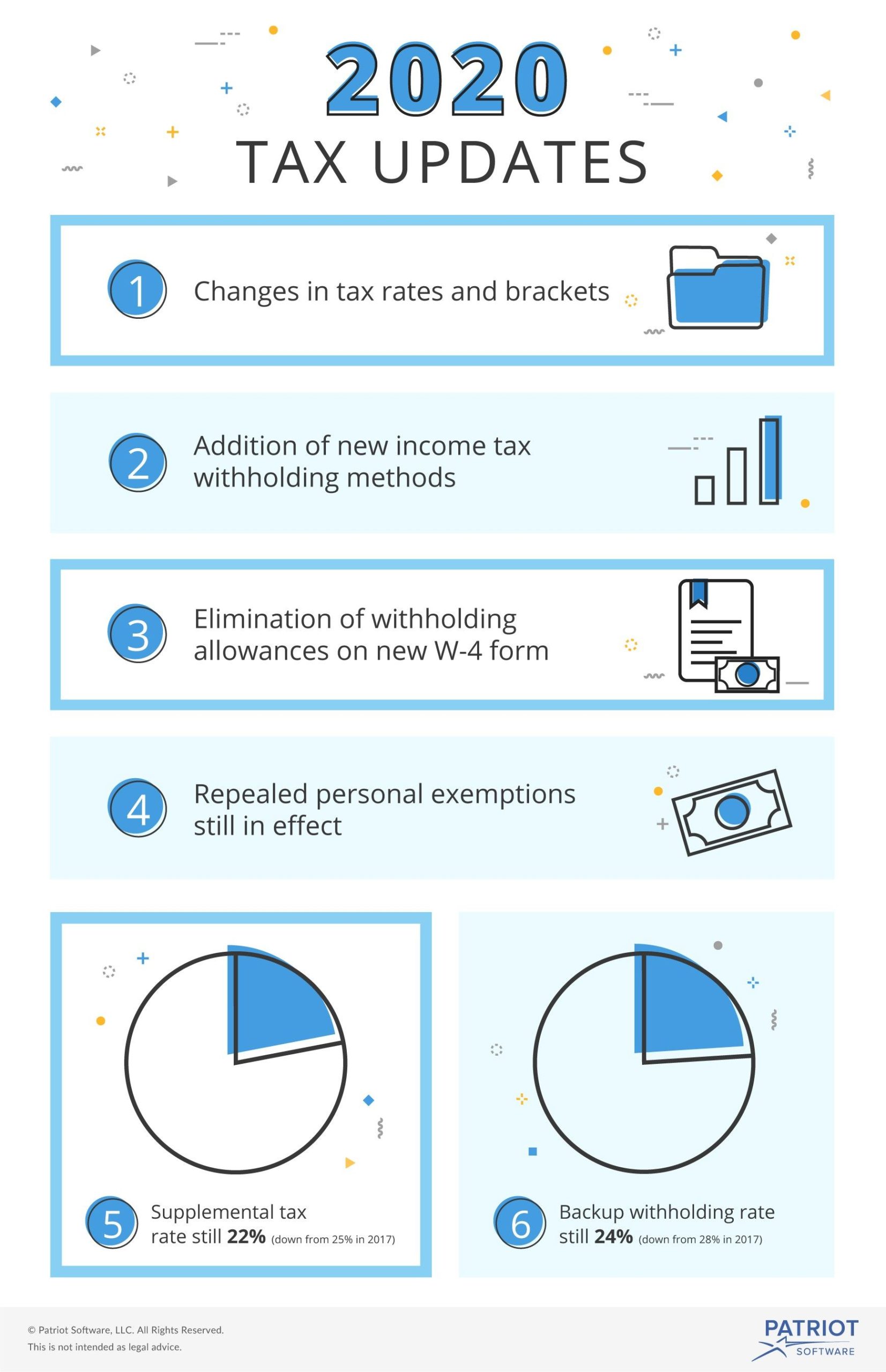

Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages.Add the taxable biweekly fringe benefits (taxable life insurance, etc.) to the amount computed in step 2 to obtain the adjusted gross biweekly wages.Subtract the nontaxable biweekly Federal Health Benefits Plan payment(s) (includes flexible spending account - health care and dependent care deductions) from the amount computed in step 1.Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages.Withholding Formula (Iowa Effective 2021) 2019 was the first revision of the Iowa withholding tables and formulas since April 1, 2006. The revisions take effect with wages paid on and after January 1, 2020. Why the state income tax is not correct The Iowa Department of Revenue has released revised income tax withholding tables/formulas and instructions to its website.

#IOWA INCOME TAX TABLES 2020 HOW TO#

How to Print Paychecks with Stubs on Blank Stock.How to Calculate Federal Withholding Tax Get Your Income Tax Refund Fast eFile File electronically.How to Create After the Fact Paychecks and Generate the Paystubs 1, interest rates for taxpayers with overdue payments will be 5 annually, 0.4 monthly, and 0.013699 daily because the prime rate averaged 3.25 over the past 12 months (October 2020 to September 2021), the department said in its guidance. federal income tax will be less if you take the larger of your itemized. How to Calculate Iowa State Income Tax Withholdings Automatically Need a Better Way to Calculate Iowa State Income Tax Withholdings?Ĭlick here to view the step by step guide on Of Allowances Claimed field as follows: FirstĪnd Third Positions - Enter the number of allowances claimed. Tax rate used in calculating Iowa state tax for year 2021 How to Print QuickBooks Checks on Blank Stock

0 kommentar(er)

0 kommentar(er)